Payroll processing is one of HR’s most important tasks. A clear payroll process helps with tax compliance and data protection, limiting financial risk. It’s also vital for keeping employees happy.

Paying people correctly and on time plays an important role in maintaining employee engagement. This also benefits you with higher productivity and a positive workplace culture.

Despite its benefits, the payroll process can be time-consuming and challenging. You must stay on top of many regulations, and any errors can damage your reputation with staff and customers. The solution? You need to streamline the payroll process to make it more efficient and less burdensome for your HR staff.

In this post, we’ll explore the following tips to help your HR department streamline the payroll process:

- Evaluate the current payroll process

- Collaborate with accounting and finance departments

- Implement automated payroll processing

- Create a payroll schedule

- Establish standard operating procedures (SOPs)

- Implement and integrate employee self-service (ESS) tools

- Train employees on new payroll processes and software

Evaluate the current payroll process

Your first step is to evaluate your current payroll processes. That means performing a detailed audit of your workflows, training, and software (if you use payroll software).

First, ensure you clearly understand your payroll processing rules and how data travels through your workflows. This will help you identify bottlenecks and other inefficiencies.

Next, note down which staff members do what and when at each stage, and look for areas of weakness. Are they technical, procedural, or human errors? Identifying the cause can help you prevent similar errors in the future. Also, look for redundancies that slow down the process, like unnecessary checks.

Once you’ve completed your audit, you can prioritize the identified issues and create a framework for addressing them. This framework should consider your broader business goals, budget, resources, and legal compliance.

Alternatively, you can hire a professional to audit your payroll process. External auditors may catch errors you hadn’t noticed, like upstream transaction errors. They’ll also pick up any fraudulent activity.

Collaborate with accounting and finance departments

Any effort to streamline the payroll process must involve your other business departments, especially your accounts department. Payroll affects every aspect of your business. So, it’s important to encourage collaboration between your department heads and staff.

Your HR team needs to find out what information other departments need to make payroll go smoothly. For instance, say HR awards an employee a pay rise or bonus. They should communicate this to accounting to ensure they reflect the changes in the employee’s cheques.

You also need to keep your finance department in the loop of any payroll changes so they can ensure the funds are in place to pay employees on time.

To encourage collaboration between your HR, accounting, and finance departments, ensure everyone knows their role and encourage the sharing of critical information. For instance, employee benefits, payroll cost, payroll processing time, etc.

If your teams work remotely, it’s also worth investing in video conferencing for remote collaboration. That way, all your employees can access the same payroll information and easily communicate any changes一wherever they are in the world.

Implement automated payroll processing

A great way to boost the efficiency of your payroll process is to automate it. Automation speeds up the process and ensures you always have an accurate payroll. Plus, automation frees your HR staff to focus on other essential tasks, such as employee recruitment and onboarding.

A good option is to invest in accounting software with payroll. Accounting software automates and integrates your accounting and payroll workflows, reducing errors and promoting collaboration. You can also pull in real-time data from your bank feeds, letting you manage your finances on a single, secure platform.

With employee self-serve, there’s no need to print payslips every month. They can be easily and securely accessed by your staff from wherever they’re based.

The software can process weekly, bi-weekly, and monthly payrolls, helping you pay staff efficiently and on time. Plus, it keeps you compliant with the latest regulations for each tax year.

In addition, payroll software automatically enrols employees in workplace pensions. You can also analyze your payroll and people costs, ensuring you make the best decisions. And any employee pay changes are automatically reflected in their next payslips.

Create a payroll schedule

Another way to streamline the payroll process is to create a set payroll schedule. This is a great way to give employees peace of mind, as they’ll always know when to expect their payslips. Plus, your HR staff will know exactly when to execute each of their duties, boosting efficiency.

Base your payroll schedule on factors like payment frequency (weekly, bi-weekly, or monthly) and direct deposit processing times. Also, consider bank and company holidays, as you’ll need to process payroll early (or late) on these occasions.

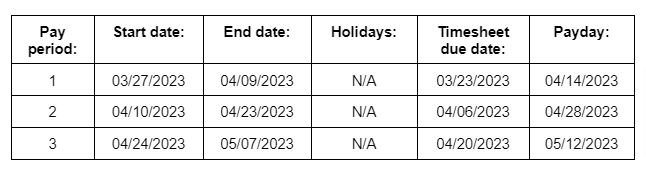

To create your schedule, you can choose from a range of templates online, or create your own. Here’s an example to get you started:

Image Created by Writer

Once you’ve created your schedule, share it with your HR staff and post it online or around the office for your employees to view.

Establish standard operating procedures (SOPs)

Standard operating procedures (SOPs) tell employees how to execute tasks in a standardized way. Establishing SOPs for payroll boosts staff efficiency, as they don’t waste time searching for information or asking for help.

SOPs break down the payroll process into simple steps, reducing the learning curve for new hires. Plus, they minimize errors and help you stay compliant with relevant legislation. Remember, the IRS penalizes one in three businesses for payroll mistakes.

It’s a good idea to use process mapping to create SOPs for payroll audits, payroll processing, employee timesheet approval, and so on. There are several formats to choose from, including checklists, flow diagrams, and videos.

Which format you use depends on each process’s complexity and your staff’s needs. But you could create SOPs in several formats so employees can choose the best format.

Use simple, clear language and include images or screenshots of tools in action so everyone understands what to do. Also, consult your accounting and finance departments to get their input, and decide which metrics you’ll use to evaluate your SOPs.

A workflow documentation tool like Document360 or Process Street can capture SOPs while your team works. This makes establishing SOPs less of a hassle. It also stores all your SOPs in a central database for easy viewing.

Implement and integrate employee self-service (ESS) tools

Employee self-service (ESS) tools can streamline the payroll process by allowing employees to take control of their pay.

With the right tools, employees can view documents, track attendance, make time off requests, and update their details without going through HR. So, ESS tools can free up your staff and boost employee satisfaction.

For example, the best payslip software includes a secure self-service portal for employees to view their current and historical payslips. They can print or save copies as needed, freeing up your HR team to focus on other tasks.

Plus, since the software is cloud-based, your employees can access it on their chosen devices.

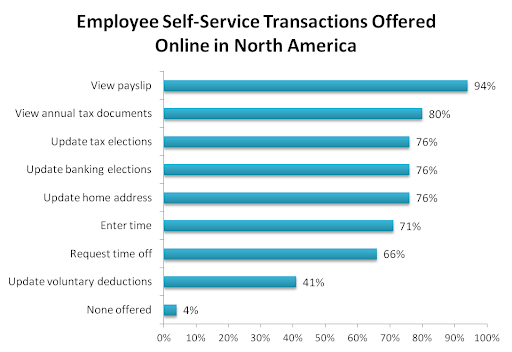

As you can see from the graph, there are many applications for ESS tools, from updating employee information to requesting leave. Companies in North America offer a high percentage of these services, with the ability to view payslips the most common.

Train employees on new payroll processes and software

Finally, you need to train your employees on your new payroll processes and software. This avoids confusion and makes sure everyone understands how and when you'll pay them. It also means your HR staff follows the same procedures, reducing mistakes.

Make sure all your employees review your standard operating procedures and payroll schedule. Also, train staff on any new payroll or workflow-tracking software you invest in, like RoundPie. This will reduce user errors that could otherwise delay payments or breach tax regulations.

Good training will also give staff the knowledge to solve problems on their own, without asking supervisors for help. In a recent survey, 85% of respondents said that being confident in their technology allows them to excel at work.

Here are some tips for training your payroll staff:

- Use HR “champions” to test new SOPs and software so they can reassure and encourage their colleagues

- Make sure you deliver training sessions at the appropriate level and relate them to your staff's day-to-day functions

- Provide online learning resources like quizzes, videos, and bite-sized modules for staff to work through in their own time

Takeaway

As you’ve seen, the best ways to streamline the payroll process are standardization, collaboration, and the right technology.

By streamlining your payroll process, your HR staff will save a great deal of time. They’ll also be more efficient and productive. Plus, payroll will be less confusing for employees, as they’ll know exactly when and how they’ll get paid.

Track the success of your changes by monitoring your performance metrics and gathering feedback from your staff. You’ll also want to conduct an annual or bi-annual in-depth audit to see if you can make any other improvements to streamline your payroll workflows further.

About the author:

Ryan Grundy is an experienced writer of business content, with a background that spans both brand and marketing agencies. He has helped tech businesses find the right words across a range of formats, from web and social to campaigns and concepts.

What would you like to know, and what would be the best way to share this information with you? What are the best tips & tricks, what workaround do you use? We'd really appreciate your insight on these ones to make our integrations better, more productive, and much more efficient. Comments, tweets are always welcome.